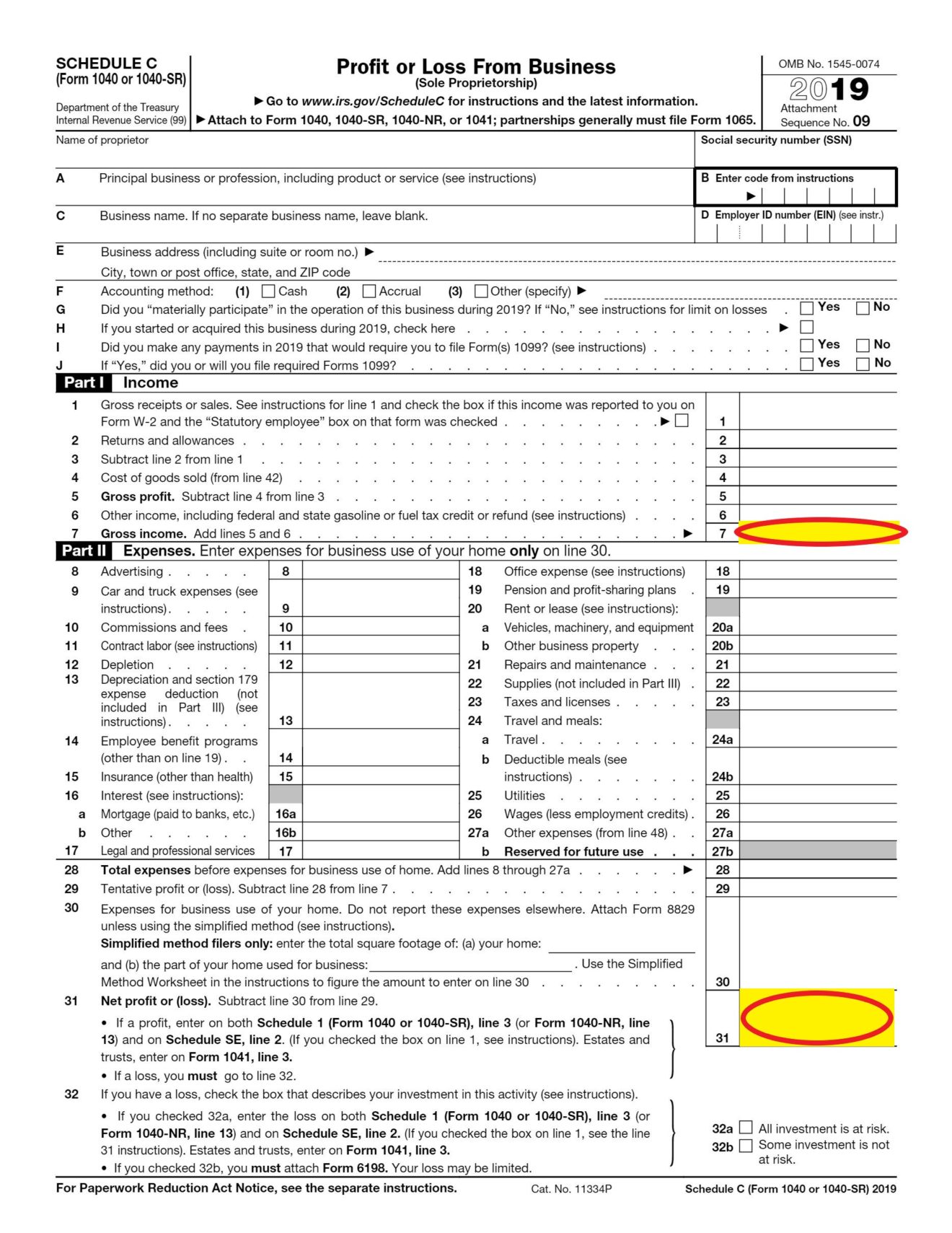

Form Schedule C 2025 - Form Schedule C 2025 Debra Eugenie, The irs uses the information in the schedule c tax form to calculate how much taxable profit you made—and assess any taxes or refunds owing. IRS Form Schedule CEZ (Form 1040), Net Profit from Business, Schedule c is a tax form essential for maximizing tax deductions, so you keep more of what you earn.

Form Schedule C 2025 Debra Eugenie, The irs uses the information in the schedule c tax form to calculate how much taxable profit you made—and assess any taxes or refunds owing.

The resulting profit or loss is typically. This handy form reports your unincorporated enterprise’s income, expenses, profit, and.

Form Schedule C 2025 Debra Eugenie, It’s part of the individual tax return, irs form 1040.

2025 2025 Forms And Instructions Synonym Jennifer Wright, Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business.

2025 Form 1040V at sasdioceseblog Blog, An activity qualifies as a business if your primary.

Schedule C What Is It, How To Fill, Example, Vs Schedule E, File your schedule c with the irs for free.

Form Schedule C 2025. Schedule c is a tax form used by unincorporated sole proprietors to report their business income and expenses. Use schedule c to calculate whether your business had a taxable profit or a deductible loss.

Form Schedule C 2025 Debra Eugenie, Profit or loss from business is an internal revenue service (irs) tax form that is used to report income and expenses for a business.

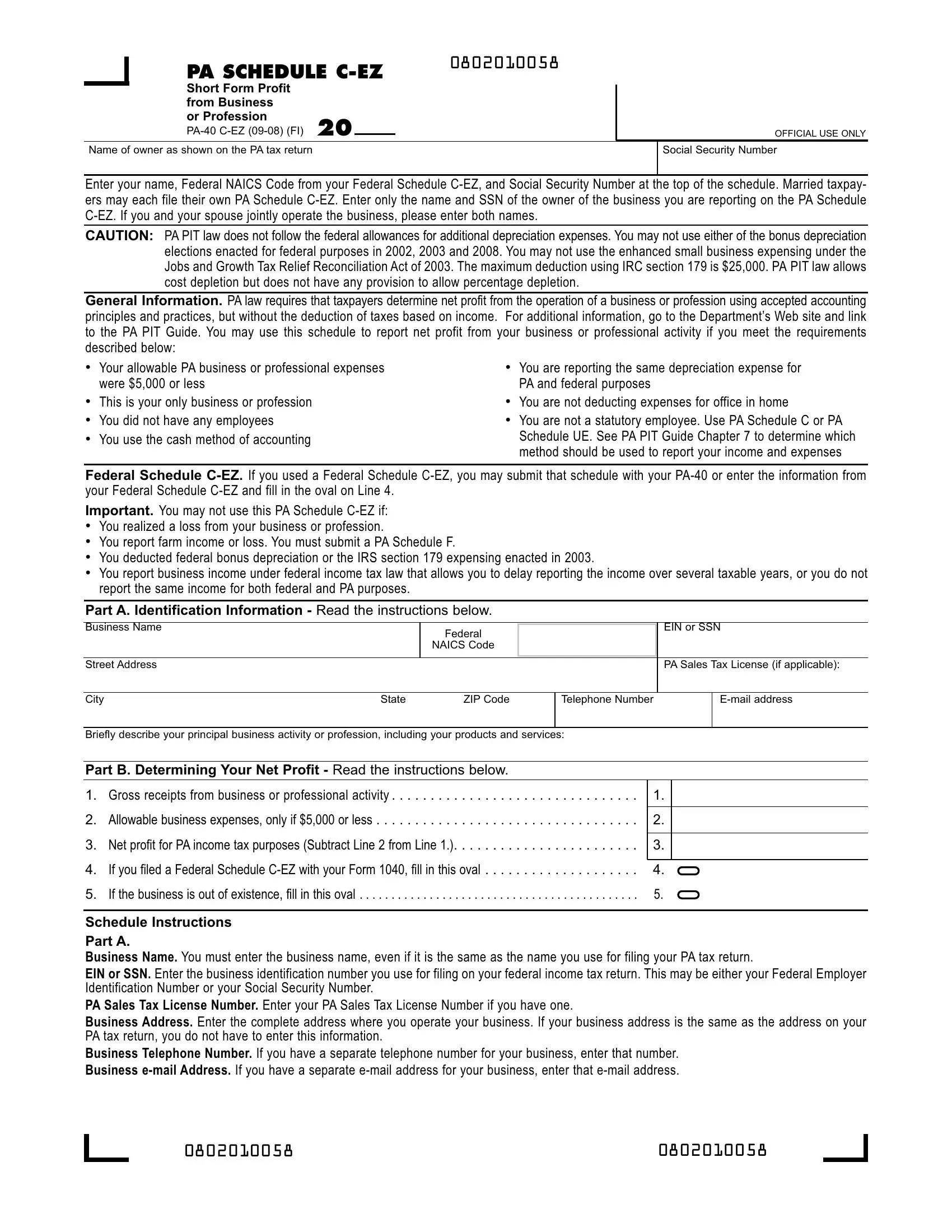

Pa Schedule C Ez Form ≡ Fill Out Printable PDF Forms Online, Profit or loss from business as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax return.

IRS 1040 Schedule 3 20252025 Fill and Sign Printable Template, You fill out schedule c at tax time and attach it to or file it electronically with form 1040.

ABOR steps up FAFSA resources for Arizona high school seniors as the, Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.